2023: What California Home Buyers and Home Sellers Need to Think About

The pandemic has caused a lot of changes in the housing market, and over the past few years we've seen sub-three percent mortgage rates, fast-paced bidding wars, and record-low inventory. However, more recently we've seen a correction in the market, with higher...

Wells Fargo fined for Wells Fargo-ing. Again.

On Tuesday, federal regulators fined Wells Fargo $1.7 billion for "widespread mismanagement" over multiple years that harmed over 16 million consumer accounts. The Consumer Financial Protection Bureau (CFPB) described the bank's "illegal activity" as including...

Mortgage Rates Fall for 5th Week in a Row

Hot on the heels of the Fed announcing another interest rate increase, data has come in showing that mortgage rates have decreased for the fifth week in a row. This is a timely reminder that the Fed does not set mortgage rates, individual banks and lenders do, and...

Fed’s Latest Rate Increase: What You Need to Know

The Federal Reserve took a historic step Wednesday, raising its benchmark interest rate by 50 basis points, putting the key benchmark federal funds rate at a range of 4.25% to 4.5%. This marks the fourth rate increase this year and the ninth since 2015. With this...

Have we turned the corner on inflation? Mortgage rates down.

Recent economic data shows that food inflation is rising at a faster rate than overall inflation, with grocery prices rising by 12%, menu prices increasing by 8.5%, and eggs becoming 49.1% more expensive through November. Inflation cooled more than expected in...

Housing market shows signs of stabilization amid lower rates

The housing market has been showing signs of stabilization in recent weeks, thanks in part to lower mortgage rates. Purchase application data for the last week of November showed a 3% decline week-over-week, but the year-over-year decline of 40% is the smallest since...

Buying Your First Home In California When Mortgage Rates are High

As a first-time homebuyer, it can be overwhelming to consider buying your first home when mortgage interest rates are high. With the current state of the economy, mortgage rates have been on the rise, making it difficult for first-time homebuyers to take the plunge....

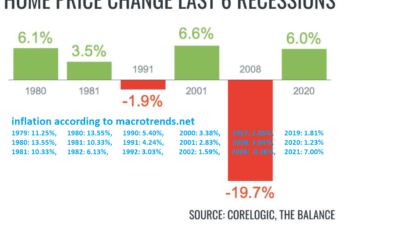

Recessions, Inflation, Home Values: Correlations?

Just for kicks, I took a chart showing recessions and home value changes during those recessions, and overlaid inflation the year before, of, and after, the start of the respective recession. Here it is: Sources are: Corelogic, The Balance, macrotrends,net, and (for...

Debunking: “You need two years on the job to get a good mortgage”

One of the most common misconceptions is that you always need two years on the same job to get a decent mortgage. This is not true! Each scenario is different, but for W2 base salary or full time consistent hourly income, generally speaking you can get a mortgage with...

2022 Mortgage Industry Implosion Tracker

In March 2020, the Fed cut rates to 0%. Mortgage rates do not track 1-to-1 with the Fed rate, but by August 2020 it was the case that the highest rates available for vanilla normal mortgages were lower than the lowest rates, for the same, that been available in 2019....